Cutting-edge finance software

Every solution we build is grounded in accounting logic and engineered for scale. Here are our core areas.

IFRS 9 Expected Credit Loss (ECL) Automation Tool

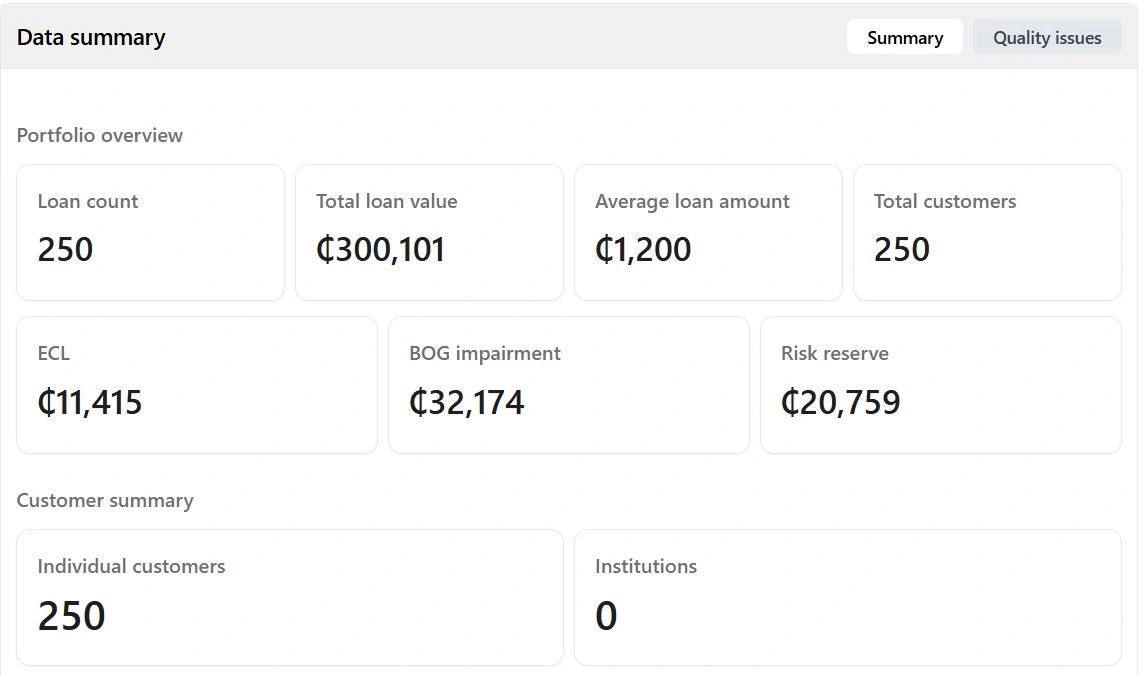

This tool automates Expected Credit Loss (ECL) computation in compliance with IFRS 9 Financial Instruments. The system is designed to help financial institutions, including banks and microfinance institutions, calculate and report impairment losses on financial assets. The tool specifically aligns with the Bank of Ghana’s regulatory requirements, ensuring compliance with local supervisory expectations while maintaining international accounting standards. The application is built as a data-driven, predictive risk assessment tool, leveraging statistical models (Logistic Regression, etc ) and Probability of Default (PD) estimations to classify loans into IFRS 9’s three-stage model. The system offers robust data ingestion, processing, and reporting functionalities, with integration capabilities for banking systems.

Key Features & Functionalities

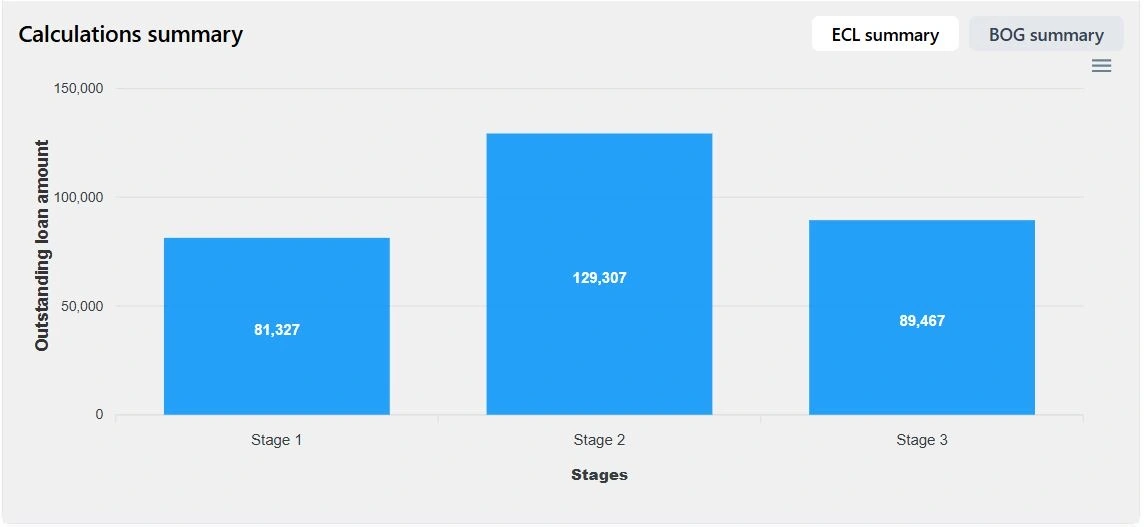

Loan Classification into IFRS 9 Stages

The system automatically classifies financial assets into the three IFRS 9 stages based on pre-defined triggers:

- Stage 1: Performing Loans – 12-month ECL applied.

- Stage 2: Underperforming Loans – Lifetime ECL applied due to a significant increase in credit risk (SICR).

- Stage 3: Credit-Impaired Loans – Lifetime ECL applied for defaulted loans.

Triggers Used for Classification:

- Qualitative: Borrower financial distress, industry downturns, or internal watchlist.

- Quantitative: Probability of Default (PD) increase thresholds.

- Backstop (DPD-based): 30+ days past due → Stage 2, 90+ days past due → Stage 3 (default).

Loan Classification into IFRS 9 Stages

The application leverages Logistic Regression models to predict the Probability of Default (PD) for each loan. * PDs are calculated at both 12-month and lifetime horizons.

- Adjustments for forward-looking macroeconomic factors, such as GDP growth, inflation, and interest rate movements, using economic scenario weightings.

- Segmentation of loan portfolios based on borrower characteristics and risk profiles.

Exposure at Default (EAD) & Loss Given Default (LGD) Calculation

- EAD: Captures the expected loan balance at default, considering repayment schedules, accumulated arrears, and any planned future drawdowns.

- LGD: Estimates potential recoveries using EAD as starting point and adjusting for accumulated arrears, collateral values, and workout strategies.

Final ECL is computed as: ECL=PD×LGD×EADECL = PD \times LGD \times EAD

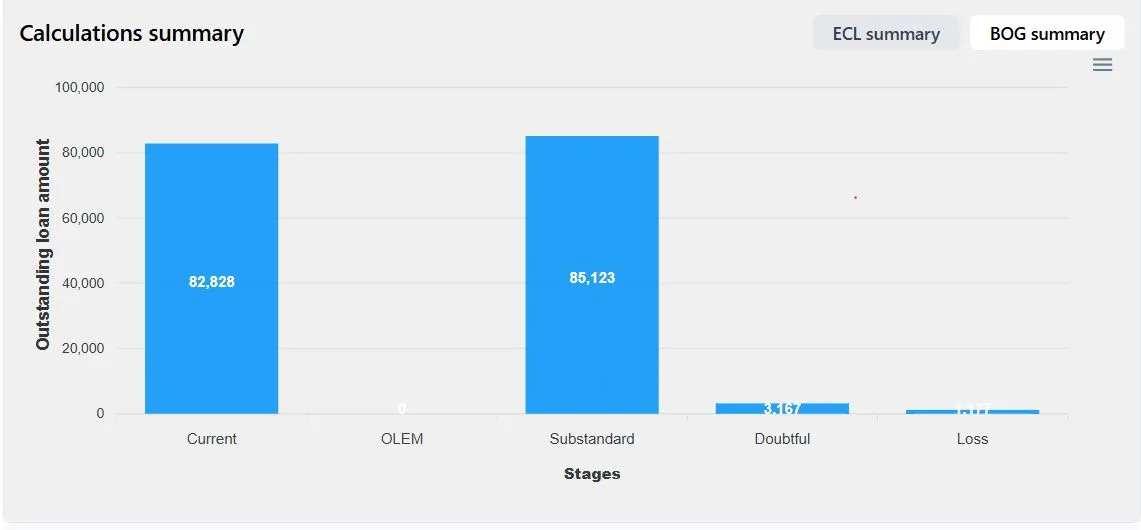

Compliance with Bank of Ghana’s Impairment Framework

- The system integrates Bank of Ghana’s guidelines on loan loss provisioning to ensure compliance with both IFRS 9 and local regulatory frameworks.

- Incorporates the Prudential Classification & Provisioning (PCP) framework, aligning regulatory provisions with IFRS 9 impairment methodology.

- Dual reporting approach:

IFRS 9-based ECL computations. Bank of Ghana-specific provisioning adjustments (where applicable).

Data Integration & API Connectivity

- Seamless data ingestion from Core Banking Systems (CBS), Accounting Software, and Loan Management Systems via APIs.

- Ability to upload and process historical loan data for predictive modeling.

Automated Financial Reporting & Dashboards

- IFRS 9-compliant ECL reports for financial statements.

- Regulatory impairment reports tailored to Bank of Ghana’s submission requirements.

- Customizable dashboards with loan staging distribution, PD heatmaps, and impairment trends.